The Critical Role of Gold Scale Calibration: The Key to Accuracy and Trust in the Global Gold Trade

The gold and jewelry business is a specialized sector. Every gram and every milligram represents significant monetary value. In all transactions—buying, selling, manufacturing, or quality inspection—the gold scale acts as the final arbiter of mass. However, all precision measuring instruments are susceptible to drift and inaccuracy over time. Environmental factors and regular use cause this inaccuracy. Therefore, gold scale calibration is not just a technical procedure; it is a vital necessity. Calibration determines the accuracy, transparency, and reputation of any precious metals business.

1. Understanding the Core: Calibration vs. Verification

To fully appreciate the importance of calibration, we must distinguish it from legal verification.

Calibration (The Technical Check)

Scale calibration involves quantitatively comparing the scale’s readings against a known measurement standard. A high-accuracy calibration weight is used as the reference. Calibration determines the scale’s error.

- Goal: The primary goal is to precisely determine the scale’s deviation at various load points. Technicians adjust the scale (if necessary) to guarantee maximum accuracy.

- Result: You receive a Calibration Certificate. This document details the measured values, the measurement uncertainty, and a comparison against the reference standard.

Verification (The Legal Check)

Scale verification (or legal metrology inspection) evaluates the scale’s conformity. It checks against national legal metrology requirements set by government regulatory bodies. This process ensures the scale meets specific technical criteria for trade use.

- Goal: This confirms the scale is legally fit for commercial transactions.

- Result: Inspectors issue a Verification Stamp/Seal or Certificate of Verification, with a final conclusion of “Pass” or “Fail.”

In Summary: Calibration optimizes technical accuracy, while Verification ensures legal compliance. Significantly, businesses must perform both procedures periodically for scales used in the gold trade.

2. The Absolute Role of Calibration in the Precious Metals Industry

Routine calibration provides fundamental benefits. These range from economic and legal protection to brand building.

The Four Pillars of Calibration Compliance

Ensuring Fair Trade

Building Consumer Trust

Regulatory Compliance

Protecting Assets

2.1. Ensuring Absolute Accuracy—The “Gold Standard”

The High Cost of Small Errors

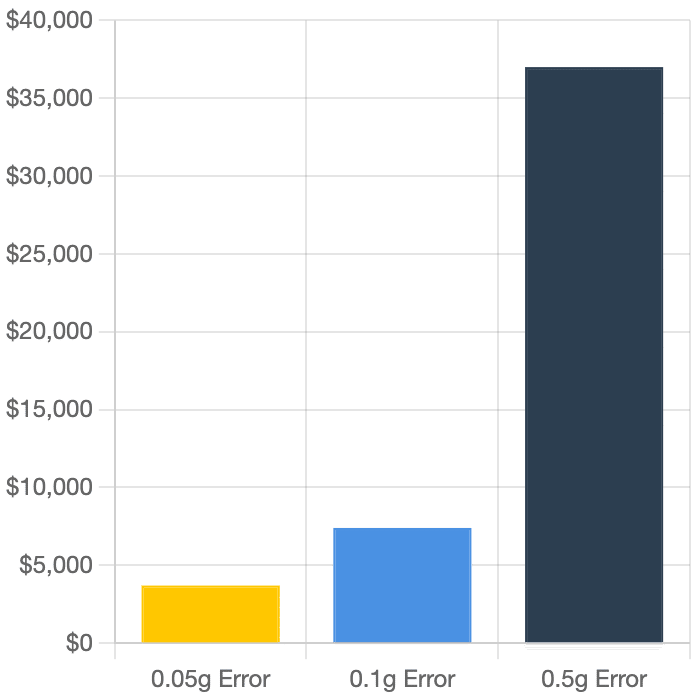

With gold prices fluctuating around $2,300 per troy ounce (~$74/gram), even tiny inaccuracies can lead to substantial financial loss. Example: potential loss from a single 1 kg gold bar transaction due to minor scale errors.

Gold is a high-value commodity. Weighing often involves very fine units. For example, an error of a few milligrams can lead to significant financial loss when transactions are frequent.

- Transparency in Trade: Accurate measurements ensure fair and transparent buying and selling. This protects the interests of both the vendor and the customer.

- Production Quality Control: Accurate weighing of materials is crucial for manufacturers. It helps control material loss, accurately cost the final piece, and ensure the gold content (fineness/karat) meets the declared standard.

2.2. Building Brand Reputation and Customer Trust

Trust is the most invaluable asset in the gold business. For this reason, a gold scale that is regularly calibrated and legally verified instills profound customer confidence. Moreover, this transparency serves as a key competitive differentiator. It confirms the business’s commitment to ethical trading practices.

2.3. Legal Compliance and Avoiding Penalties

High-value transactions often involve heavy regulation of measuring equipment. Compliance is thus necessary to avoid substantial fines or seizure of the instrument. Furthermore, calibration is the essential technical precursor. It ensures the scale is accurate enough to pass legal verification.

Compliance Is Not Optional

Federal and state laws impose strict penalties for using non-compliant scales in commercial trade.

Initial Violation

Fines ranging from $500 to $5,000.

Repeat Offenses

Fines up to $25,000 and seizure of equipment.

Fraudulent Use

Potential for business license revocation and criminal charges.

2.4. Extending Scale Lifespan and Optimizing Performance

Electronic balances are vulnerable to environmental factors and component wear. Fortunately, the calibration process allows specialized technicians to detect underlying issues early. Timely adjustment and maintenance prevent minor errors from escalating into major breakdowns.

3. Upholding Legal Standards: The US Regulatory Framework (NTEP & NIST)

The US has rigorous regulations for commercial scales, which it calls “Legal-for-Trade” applications. Gold weighing directly falls under these requirements.

The Role of NIST Handbook 44

The NIST Handbook 44 is the primary regulatory document for weighing devices across the US. The National Institute of Standards and Technology (NIST) publishes it.

- Uniformity: Almost all state and local weights and measures jurisdictions adopt and enforce Handbook 44. This creates a critical uniform standard for investigating and verifying commercial scales.

- Legal-for-Trade: Any scale used to determine a price based on weight must comply with Handbook 44. Gold scales are included in this mandate.

The NIST-Traceable Calibration Process

This standardized procedure, performed by accredited technicians, ensures your equipment meets the highest standards of accuracy demanded by US law.

NTEP Certification: The Pre-Approval Stamp

Before commercial use, a gold scale model must achieve NTEP (National Type Evaluation Program) Certification.

- The Vetting Process: The National Conference on Weights and Measures (NCWM) runs NTEP. This rigorous process ensures a specific scale model meets Handbook 44’s performance requirements.

- Accuracy Class: Gold scales often fall into NTEP Class I or Class II (Precision balances). This reflects the necessity for extremely fine resolution (e.g., or ).

- The Seal: Certified scales are typically sealed by the factory or a service agent. This prevents unauthorized adjustments, thereby preserving measurement integrity.

Calibration vs. Field Verification

Official legal check (Field Verification) is usually annual and mandatory. However, many jewelers schedule more frequent ISO/IEC 17025 accredited calibration for critical reasons:

- Preventive Measure: Calibration ensures the scale operates within legal tolerances. It guarantees the scale will pass the mandatory state inspection.

- Internal Control: Businesses often adopt a semi-annual schedule. This maintains tighter accuracy standards than the legal minimum, which eliminates internal financial losses.

- Customer Visibility: For instance, some local regulations mandate a dual display. This ensures both the merchant and the customer clearly view the accurate weight reading.

4. When is Gold Scale Calibration Necessary?

Experts recommend calibrating gold scales frequently to ensure continuous compliance and accuracy.

- Regulatory Schedule: Complete legal verification annually. Perform internal technical calibration more frequently (e.g., 6 months/time).

- After Repair: Any intrusion into the scale’s structure can change its measurement characteristics. Therefore, calibrate afterward.

- After Relocation: Moving the scale to a new location can cause mechanical shock. This affects the sensor and requires calibration.

- Upon Environmental Change: Changes in temperature, humidity, or air pressure cause measurement drift. Immediate adjustment is necessary.

- Before Use: Calibrate the scale before use after an extended period of inactivity.

Conclusion

Gold scale calibration is a necessary investment and a profitable practice. It is the foundation for establishing a trustworthy brand and securing long-term financial interests. It ensures compliance with stringent standards like NIST Handbook 44 and NTEP. A regularly calibrated and verified gold scale is the ultimate guarantee of transparency. This professionalism allows businesses to confidently navigate the high-stakes precious metals market.